In today’s fast-paced trade environment, high-performing organizations recognize the significance of proficient Extend Portfolio Administration (PPM). Executing PPM Best Practices not as it were streamlines extended forms but too drives vital arrangement, moves forward asset assignment, and boosts by and large efficiency. Let’s jump into the fundamental PPM best hones that can change your organization into a high-performing powerhouse.

In today’s fast-paced trade environment, high-performing organizations recognize the significance of proficient Extend Portfolio Administration (PPM). Executing PPM Best Practices not as it were streamlines extended forms but too drives vital arrangement, moves forward asset assignment, and boosts by and large efficiency. Let’s jump into the fundamental PPM best hones that can change your organization into a high-performing powerhouse.

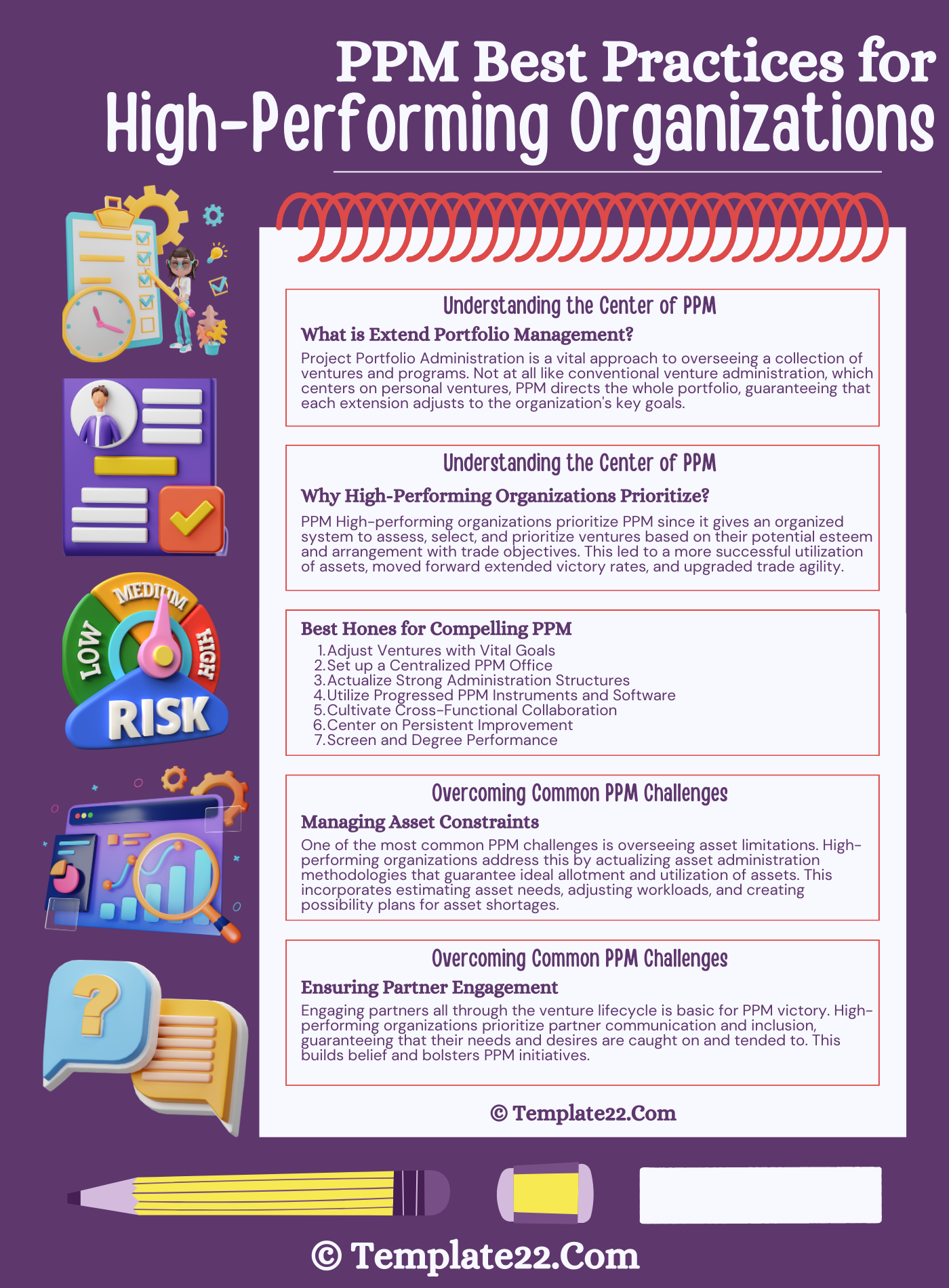

Understanding the Center of PPM

What is Extend Portfolio Management?

Project Portfolio Administration is a vital approach to overseeing a collection of ventures and programs. Not at all like conventional venture administration, which centers on personal ventures, PPM directs the whole portfolio, guaranteeing that each extension adjusts to the organization’s key goals. This all-encompassing see empowers superior decision-making, asset optimization, and hazard management.

Why High-Performing Organizations Prioritize

PPM High-performing organizations prioritize PPM since it gives an organized system to assess, select, and prioritize ventures based on their potential esteem and arrangement with trade objectives. This led to a more successful utilization of assets, moved forward extended victory rates, and upgraded trade agility.

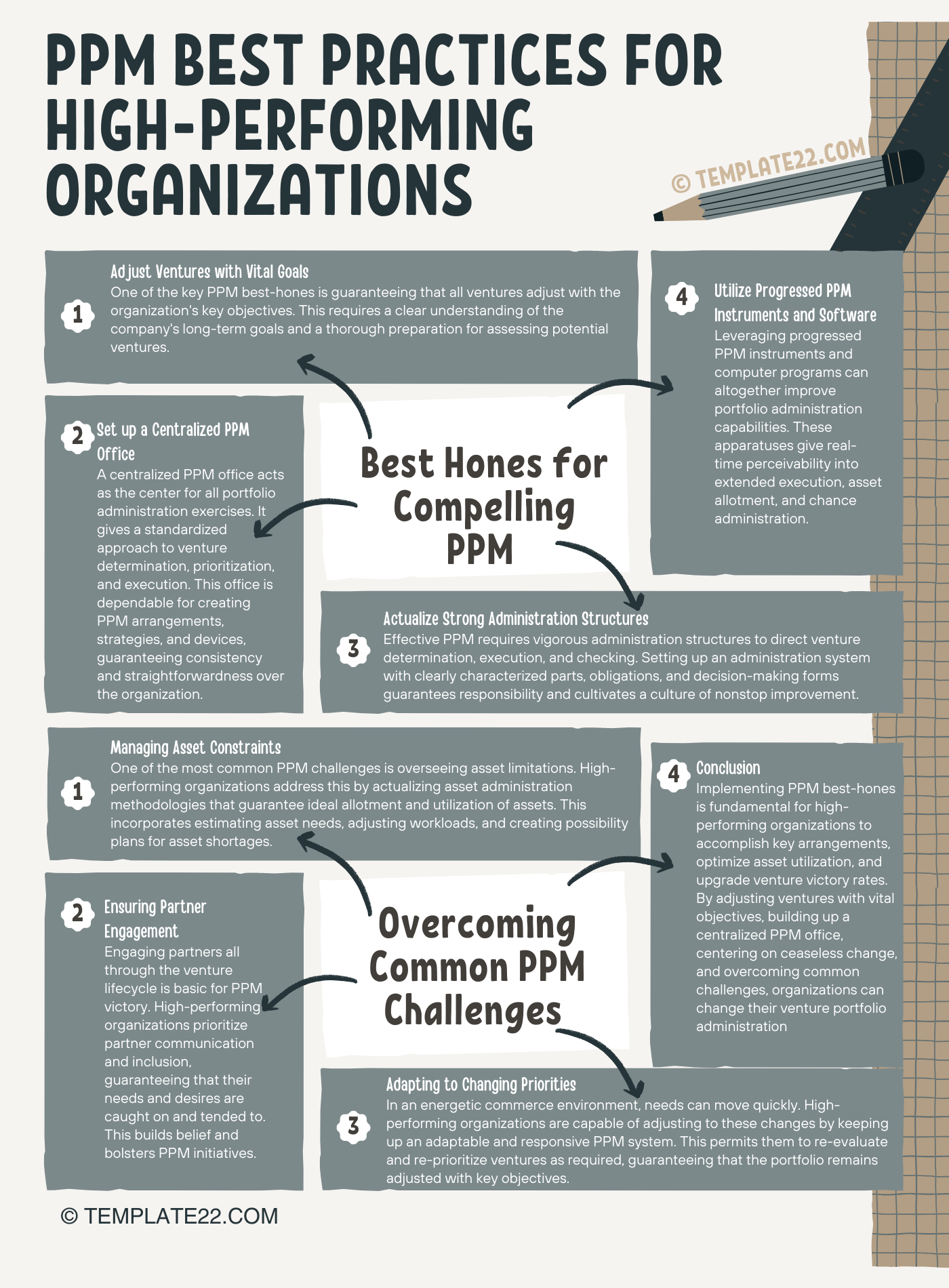

Best Hones for Compelling PPM

1. Adjust Ventures with Vital Goals

One of the key PPM best-hones is guaranteeing that all ventures adjust with the organization’s key objectives. This requires a clear understanding of the company’s long-term goals and a thorough preparation for assessing potential ventures. By prioritizing ventures that bolster vital objectives, organizations can maximize their return on venture and accomplish maintained growth.

CLICK HERE TO DOWNLOAD 300+ PROJECT MANAGEMENT TEMPLATES & DOCUMENTS IN EXCEL

2. Set up a Centralized PPM Office

A centralized PPM office acts as the center for all portfolio administration exercises. It gives a standardized approach to venture determination, prioritization, and execution. This office is dependable for creating PPM arrangements, strategies, and devices, guaranteeing consistency and straightforwardness over the organization.

3. Actualize Strong Administration Structures

Effective PPM requires vigorous administration structures to direct venture determination, execution, and checking. Setting up an administration system with clearly characterized parts, obligations, and decision-making forms guarantees responsibility and cultivates a culture of nonstop improvement.

4. Utilize Progressed PPM Instruments and Software

Leveraging progressed PPM instruments and computer programs can altogether improve portfolio administration capabilities. These apparatuses give real-time perceivability into extended execution, asset allotment, and chance administration. High-performing organizations utilize these instruments to make data-driven choices, optimize asset utilization, and guarantee convenient extended delivery.

5. Cultivate Cross-Functional Collaboration

Successful PPM depends on solid cross-functional collaboration. Empowering communication and collaboration among diverse divisions makes a difference to break down silos and guarantees that ventures are adjusted to organizational needs. Customary gatherings, workshops, and collaborative stages can encourage this cross-functional interaction.

6. Center on Persistent Improvement

7. Screen and Degree Performance

Regularly checking and measuring venture execution is vital for compelling PPM. Building up key execution markers (KPIs) and utilizing them to track venture advances guarantees that any issues are recognized and tended to instantly. High-performing organizations utilize execution information to illuminate decision-making and drive ceaseless improvement.

Overcoming Common PPM Challenges

Managing Asset Constraints

One of the most common PPM challenges is overseeing asset limitations. High-performing organizations address this by actualizing asset administration methodologies that guarantee ideal allotment and utilization of assets. This incorporates estimating asset needs, adjusting workloads, and creating possibility plans for asset shortages.

Ensuring Partner Engagement

Engaging partners all through the venture lifecycle is basic for PPM victory. High-performing organizations prioritize partner communication and inclusion, guaranteeing that their needs and desires are caught on and tended to. This builds belief and bolsters PPM initiatives.

CLICK HERE TO DOWNLOAD 300+ PROJECT MANAGEMENT TEMPLATES & DOCUMENTS IN EXCEL

Adapting to Changing Priorities

In an energetic commerce environment, needs can move quickly. High-performing organizations are capable of adjusting to these changes by keeping up an adaptable and responsive PPM system. This permits them to re-evaluate and re-prioritize ventures as required, guaranteeing that the portfolio remains adjusted with key objectives.

Conclusion

Implementing PPM Best Practices is fundamental for high-performing organizations to accomplish key arrangements, optimize asset utilization, and upgrade venture victory rates. By adjusting ventures with vital objectives, building up a centralized PPM office, leveraging progressed instruments, cultivating collaboration, centering on ceaseless change, and overcoming common challenges, organizations can change their venture portfolio administration and drive long-term victory. Begin joining these best hones nowadays and observe your organization flourish.